WITH THOUGHT AND CARE

-

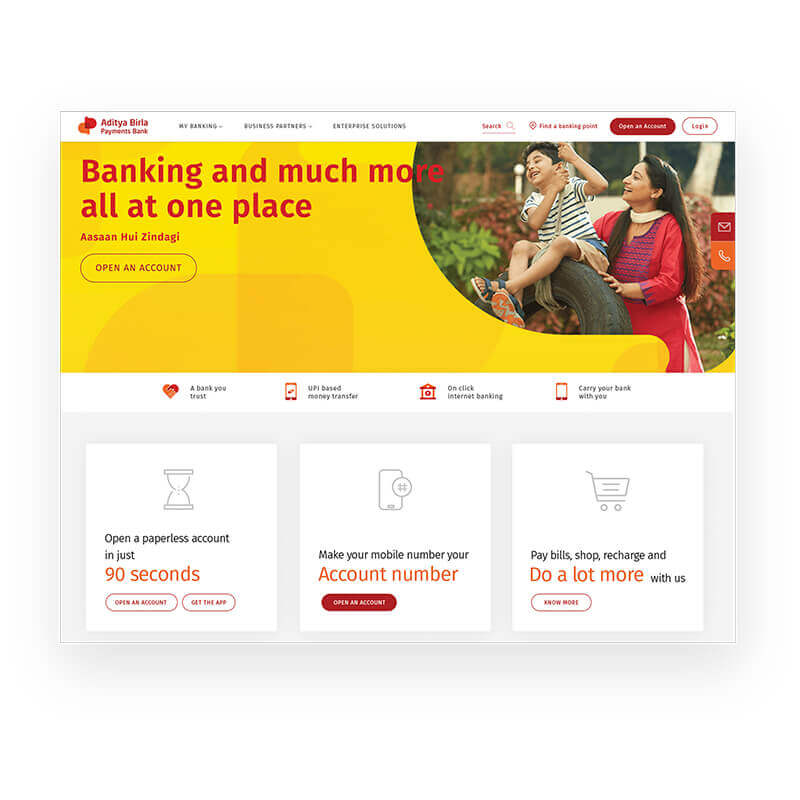

90 SECOND ONBOARDING

On-boarding continues to be the journey that sees the highest percentage of drop-offs because of how long and complex they are. Every step provides friction in terms of data that needs to be posted and verified and we often see failures.

We broke the journey into small steps and engaged with the user at each of them, encouraging them to stay the course and complete the journey

-

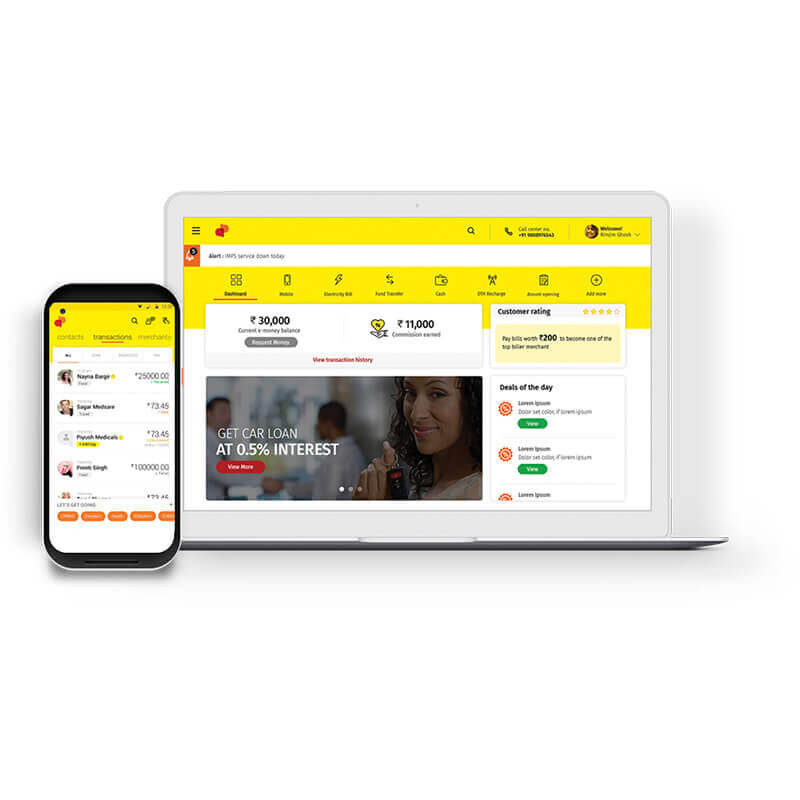

RETAIL ASSISTED BANKING

Early in the journey there was a realisation that when it comes to money, the trust lies in the hands of the retail Kirana shops which existed in the tier 3 and 4 towns. This allowed us to build a strategy around this insight which put the retailers at the centre of this ecosystem.

Incentive modules were designed to get the retailers onboarded and in turn facilitate the banking services for their customers. Retailers saw this as an opportunity to expand their services by simply signing up. It allowed them to add to their existing income sources which proved to be win win situation for both ABPB and the retailers.

-

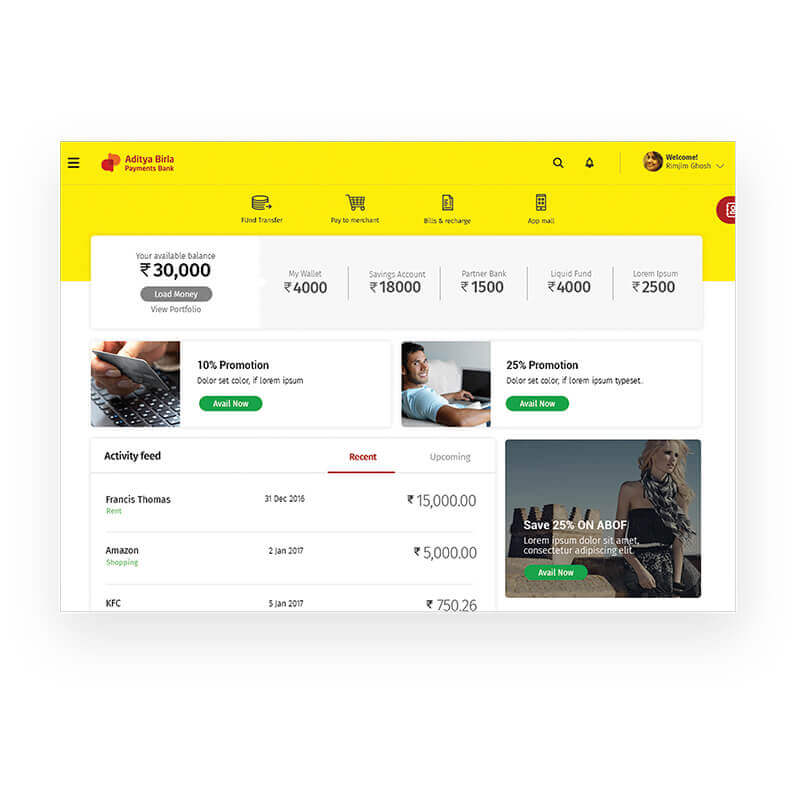

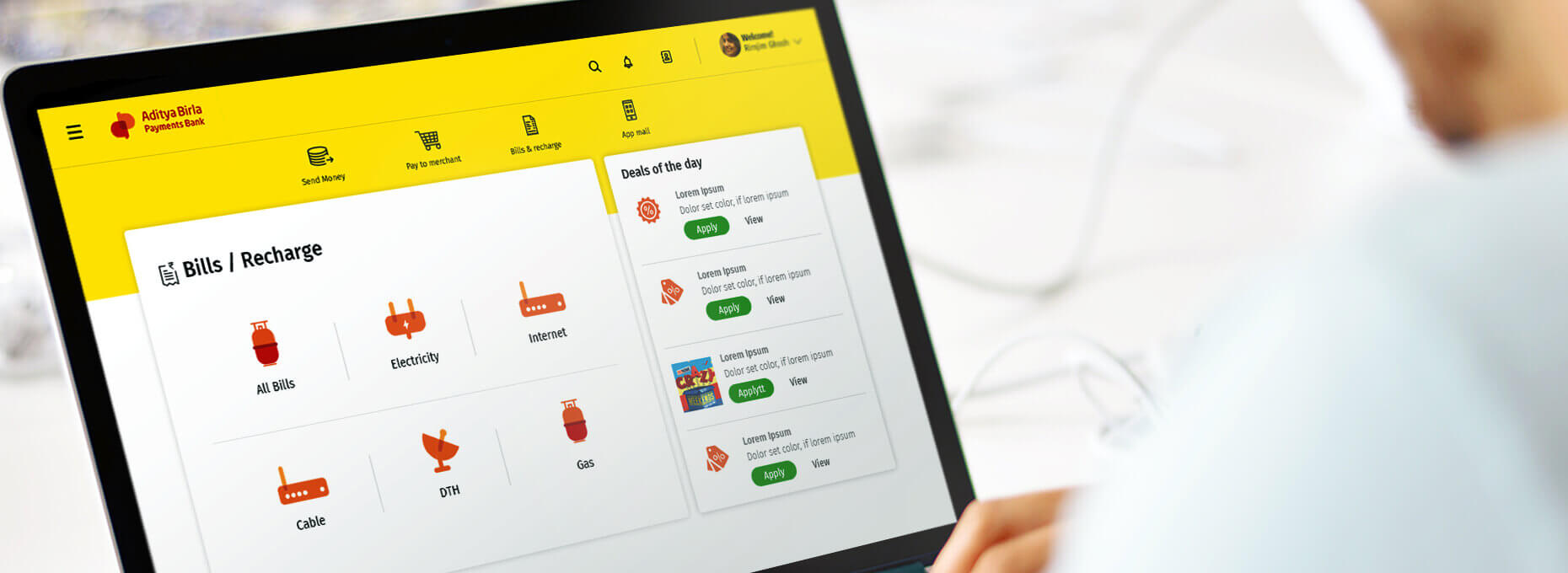

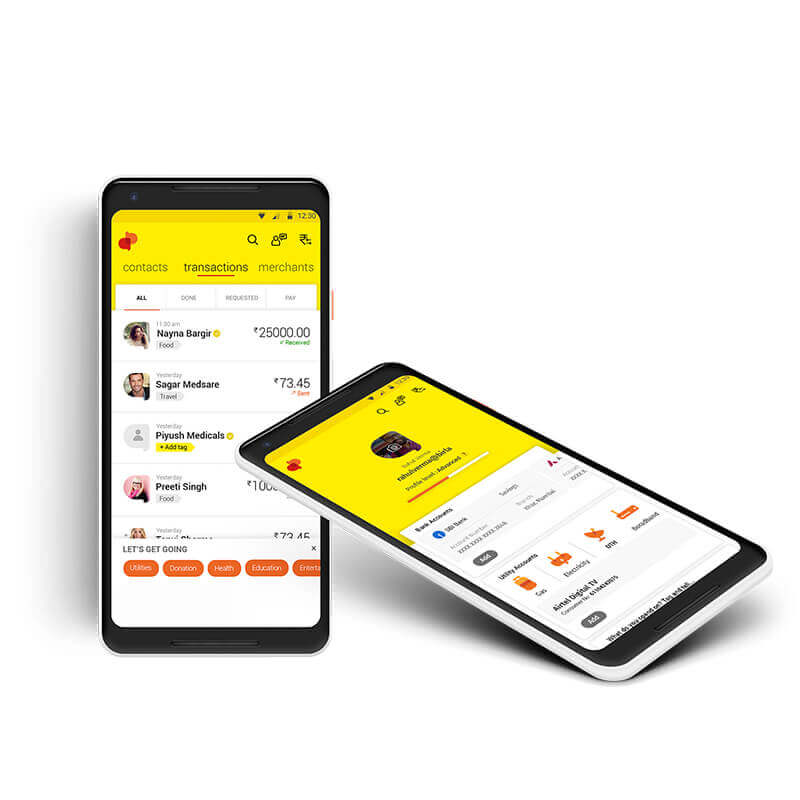

BUILDING AND TESTING INTERFACES

Fractal team used variety of methods to test the interfaces and journeys early in the project. Right from techniques like paper prototyping, Interactive prototyping, affinity mapping, and closed group testing were adopted to build designs which would yield better usability.

Different visual tools were used to make the interface as language agnostic as possible. During the research we found out about literacy standards around and tried to adopt numbers and colours to communicate rather than loads of text.

-

DATA ANALYTICS & REPORTING

We built a variety of embedded services which allowed users to analyse their spending and visualise them in very easy to read interfaces. With patterns established the bank was able to recommend services which would help them grow and protect the wealth.

With variety of services from aggregators, the reports were not only able to suggest products but also allow them to buy them online with minimum human intervention. Easily build and roll these out.