WITH THOUGHT AND CARE

-

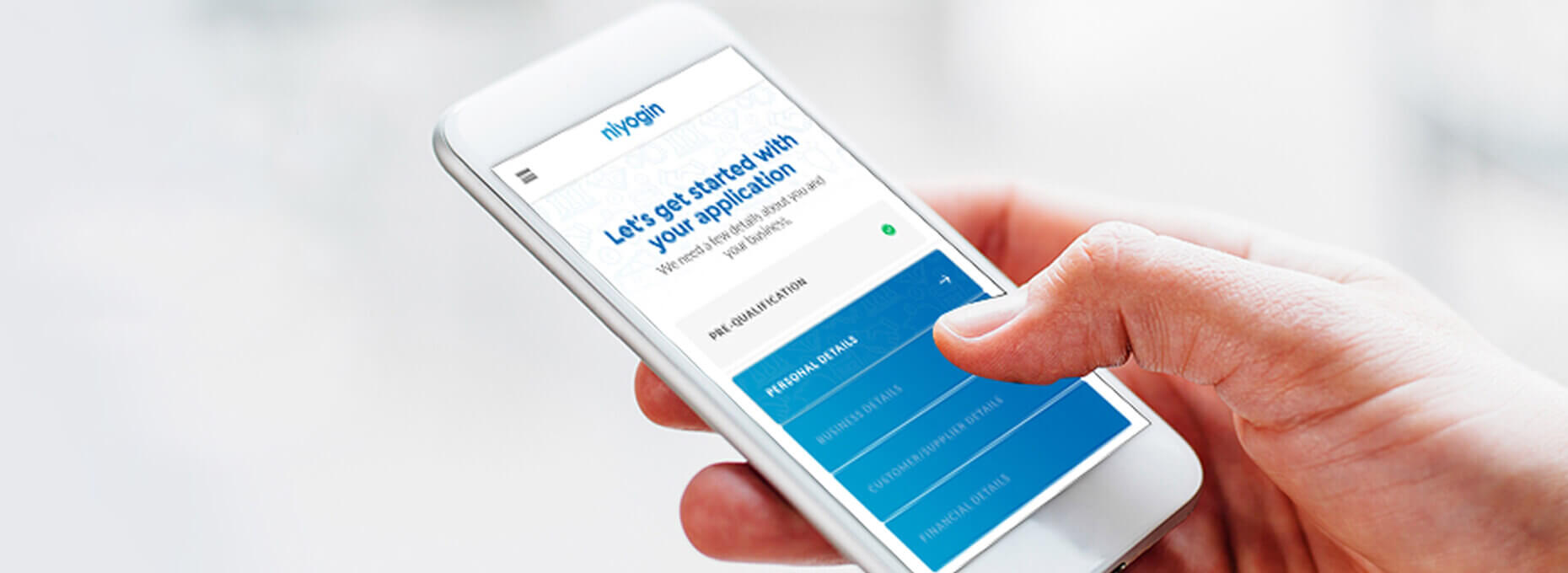

PARTNER ONBOARDING

Niyogins business model revolves around partner ecosystem. Their network of Chartered Accountants needed to be onboarded on to the platform through the sales channel. We developed both the foot on sales as well as self onboarding modules for this part of the business.

-

PARTNER PORTAL

Each partner onboarded gets an access to their exclusive portal from where they can manage the SMEs onboarding, their loan underwriting and management. This allows the partners to run this as their parallel business and profit centre.

-

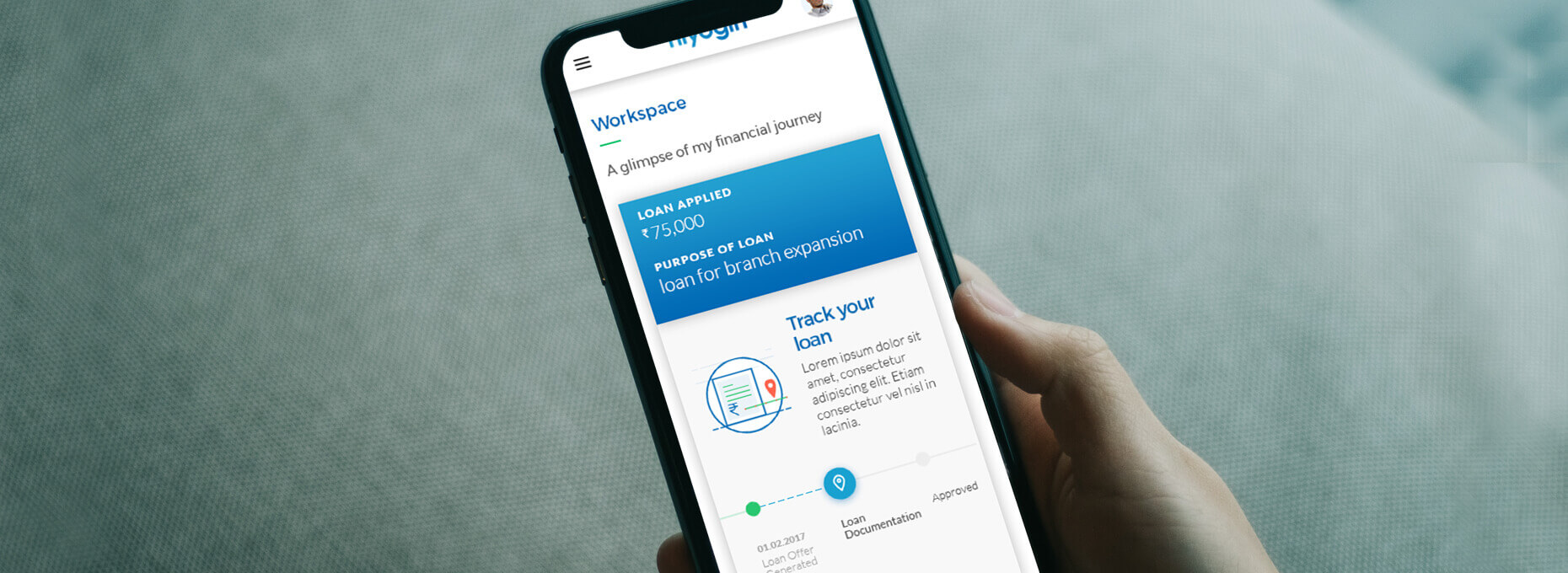

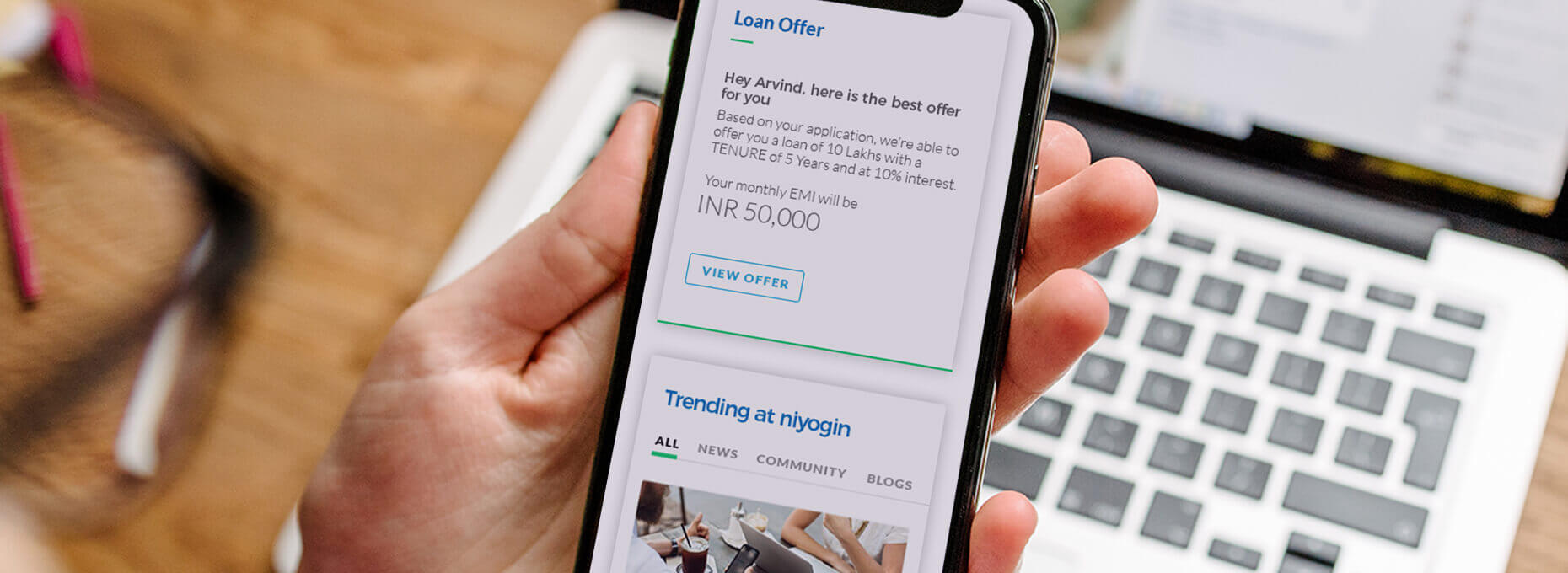

LOAN MANAGEMENT PLATFORM

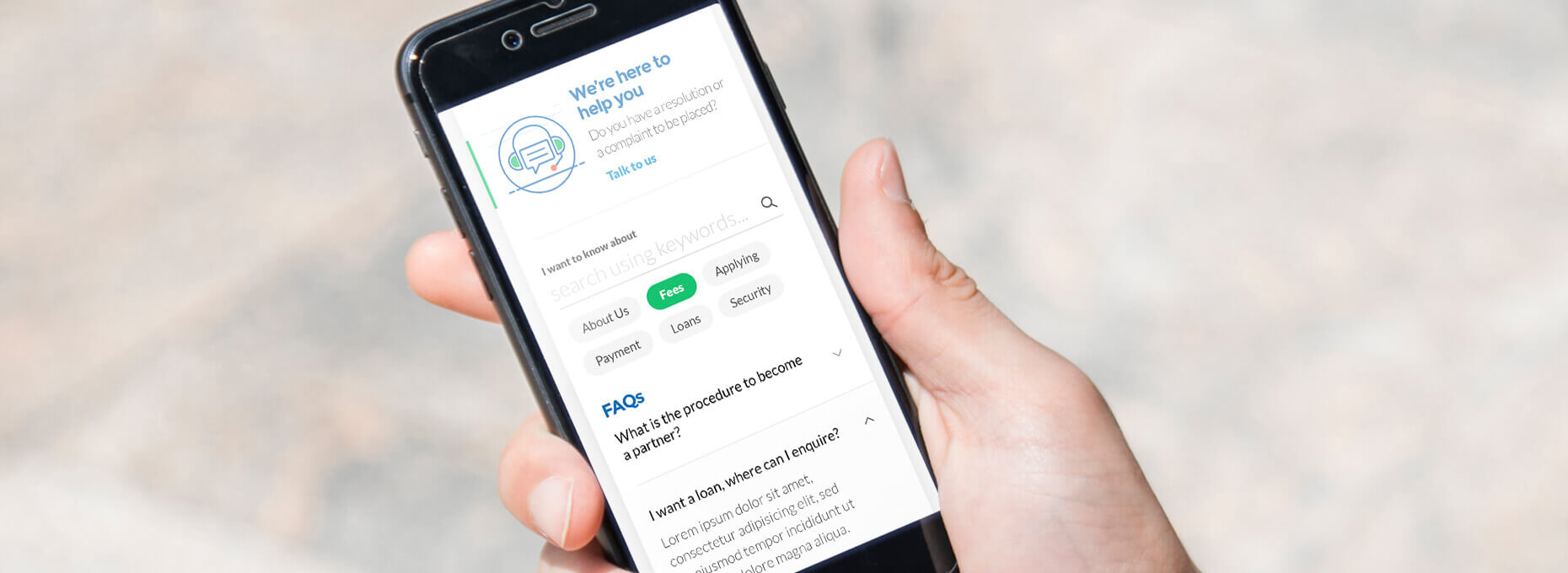

Once the loan is disbursed into the clients account it has to be managed for payments. Niyogins client portal allows SMEs to manage their whole lifecycle and relationship with Niyogin. It allows you to track, repay and also originate additional loans.

-

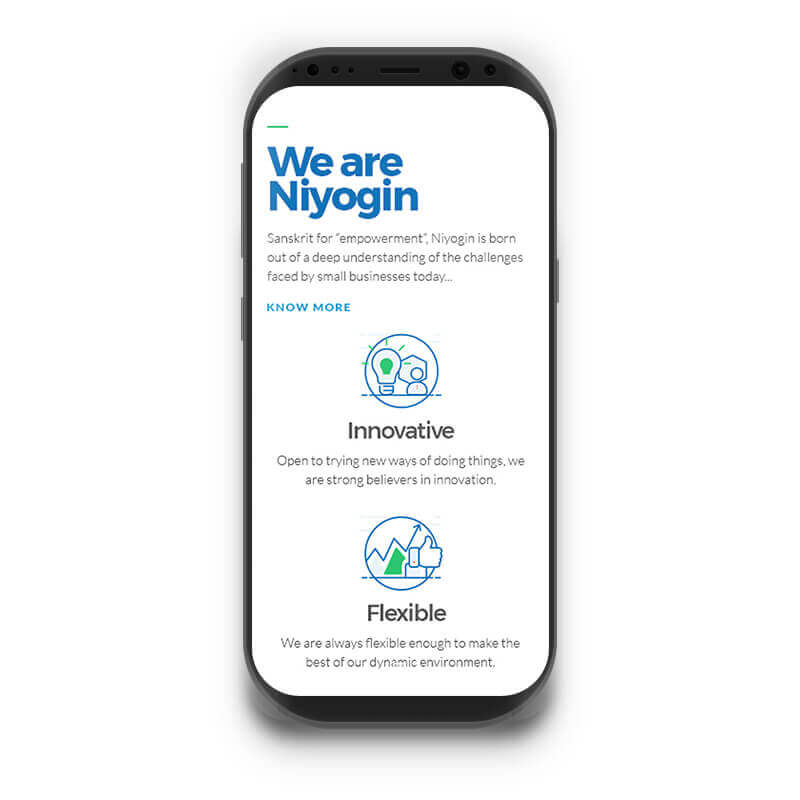

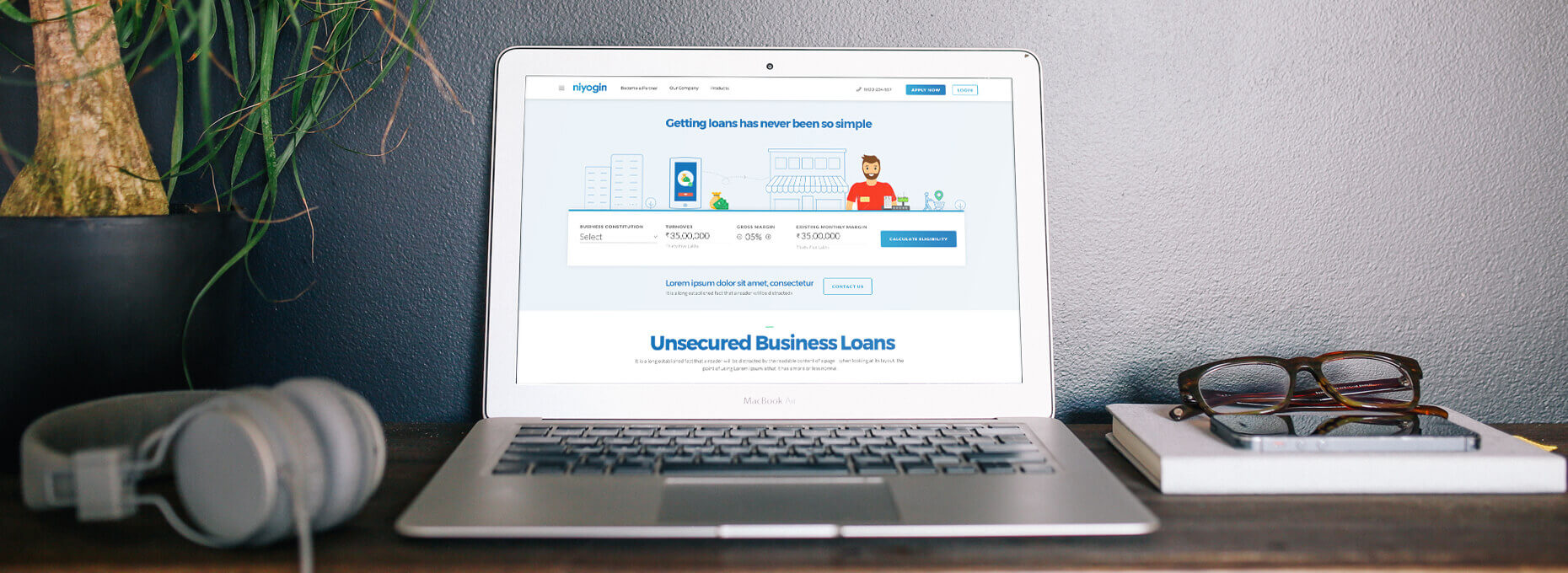

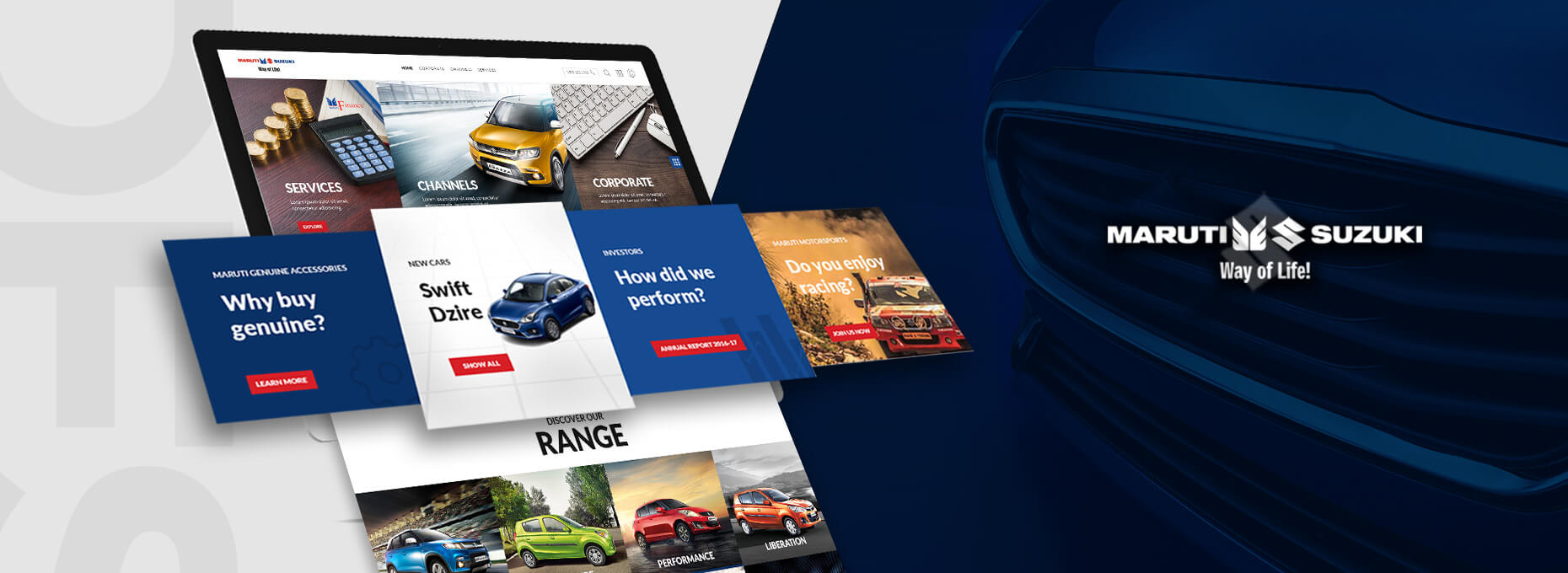

LEAD GENERATION PORTAL

Fractal developed the whole portal which allowed users and potential partners to know about the model and also drop a lead.

The website allowed its customers to completely originate a loan request completely online.

-

MARKETING VIDEOS AND TUTORIALS

Fractal helped Niyogin create a variety of marketing material which can be used by the sales and marketing team.

We also developed a series of tutorial videos and printed material design which helped partners and Clients to understand the platform and get upto speed.